Fraud Detection

Summary¶

This Neuron allows you to detect remittance transactional fraud, classify transactions into 3 categories: fraudulent, non-fraudulent or suspicious. The Fraud Detection Neurons uses machine learning models to predict the likelihood of a transaction being fraudulent based on a variety of features that gives information about the user behavior, transaction history, and geographical data. By leveraging advanced algorithms, This Neuron provides accurate and reliable fraud detection, helping businesses prevent financial losses and protect their customers from fraudulent activities.

Warning

This classification is based on the probability of a transaction being fraudulent. It is essential to consider other factors and perform additional checks to confirm the fraud status. Also this algorithm runs on the fly, Dedomena AI doesn't store any data. So, you must copy the results before closing the tab or window to avoid losing the information.

This Neuron provides a simple and intuitive way to detect fraud in remittance transactions, enabling businesses to enhance their security measures and protect their financial assets. With high accuracy and ease of use, the Fraud Detection is a valuable tool for anyone looking to prevent fraudulent activities and safeguard their financial transactions.

Say goodbye to fraudulent activities. Embrace the power of Dedomena's Fraud Detection Neuron and make informed decisions with confidence.

Use Cases

Here are some key use cases for the Fraud Detection Neuron:

- Financial Security: Protecting businesses and individuals from fraudulent activities, ensuring the safety of their financial transactions.

- Risk Management: Identifying potential fraudulent transactions in advance, allowing for proactive measures to prevent financial losses.

- Compliance: Ensuring compliance with regulatory requirements by detecting and preventing fraudulent activities in remittance transactions.

- Customer Protection: Safeguarding customers from financial fraud and ensuring the security of their transactions.

- Business Growth: Enhancing security measures to build trust with customers and partners, driving strategic growth and success.

API & Endpoints¶

/v2/fraud¶

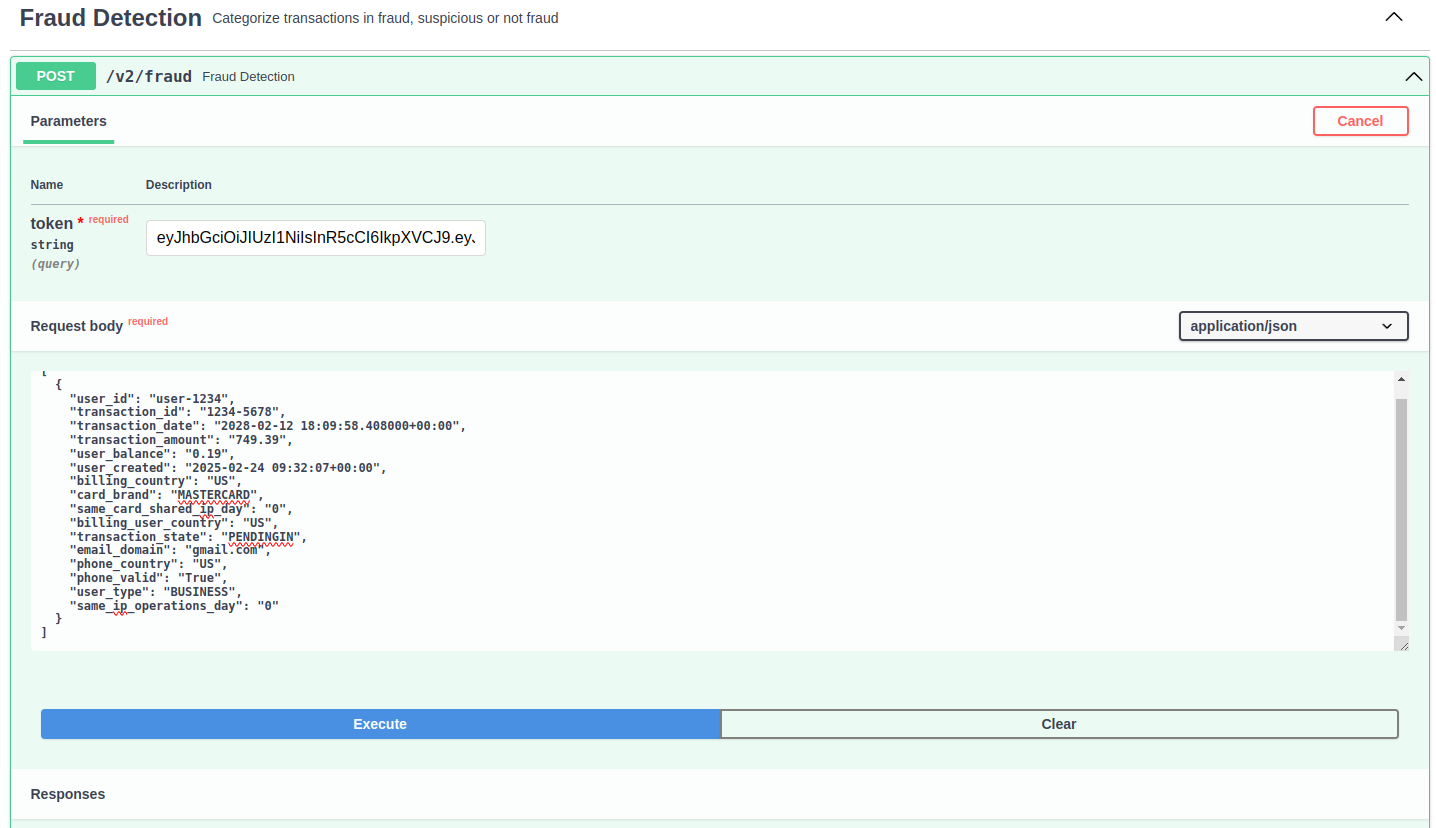

POST v2/fraud

This endpoint classifies transactions into 3 categories: Fraud, No Fraud and Suspicious.

Headers:

token: available via free trial or subscription.

Request Body:

It should be a JSON array with the following fields:

user_id(str): Unique anonymous id that identifies the user.transaction_id(str): Unique anonymous id that identifies the transaction.transaction_date(str): Date and time of the transaction.transaction_amount(float): Amount of the transaction.user_balance(float): User balance at the time of the transaction.user_created(str): Date and time when the user was created.billing_country(str): Country where the transaction was billed.card_brand(str): Brand of the card used in the transaction.same_card_shared_ip_day(int): Number of transactions with the same card and shared IP on the same day.billing_user_country(str): Country where the user is located.transaction_state(str): State of the transaction.email_domain(str): Domain of the user's email.phone_country(str): Country of the user's phone.phone_valid(str): Whether the user's phone is valid or not.user_type(str): Type of user.same_ip_operations_day(int): Number of transactions with the same IP on the same day.

Request Body - JSON Array¶

[

{

"user_id": "user-1234",

"transaction_id": "1234-5678",

"transaction_date": "2028-02-12 18:09:58.408000+00:00",

"transaction_amount": "749.39",

"user_balance": "0.19",

"user_created": "2025-02-24 09:32:07+00:00",

"billing_country": "US",

"card_brand": "MASTERCARD",

"same_card_shared_ip_day": "0",

"billing_user_country": "US",

"transaction_state": "PENDINGIN",

"email_domain": "gmail.com",

"phone_country": "US",

"phone_valid": "True",

"user_type": "BUSINESS",

"same_ip_operations_day": "0"

}

]

Responses¶

200

[

{

"transaction_id": "1234-5678",

"pred_category": 1,

"pred_category_name": "Fraud",

"pred_prob": 0.9997

}

]

Description:

The response will include a JSON array with the following fields:

transaction_id(str): Unique anonymous id that identifies the transaction.pred_category(int): Predicted category of the transaction (0: No Fraud, 1: Fraud, 2: Suspicious).pred_category_name(str): Predicted category name of the transaction (Fraud, No Fraud, Suspicious).pred_prob(float): Probability of the predicted category.

401

[

{

"detail": "Could not validate credentials"

}

]

422

[

{

"detail": "Unprocessable Entity"

}

]

429

[

{

"detail": "The maximum monthly number of calls or predictions for your account has been exceeded"

}

]

Metrics¶

Dedomena AI's model's performance metrics ensure high accuracy and reliability:

Summary:

| Accuracy | Recall |

|---|---|

| 0.99 | 0.84 |